child tax credit 2022 passed

The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years. This bill allows a child tax credit for an unborn child who is born alive.

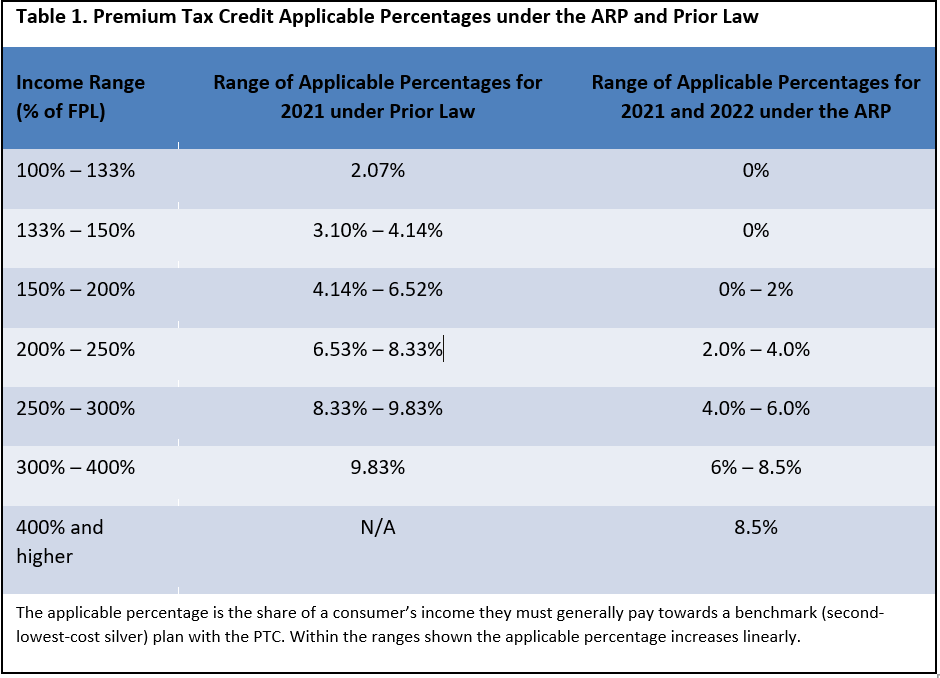

The American Rescue Plan S Premium Tax Credit Expansion State Policy Considerations

Filed a 2019 or 2020 tax return and claimed the Child Tax.

. Approved 12 trillion Bipartisan Infrastructure. Child Tax Credit for Pregnant Moms Act of 2022. Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children between 6.

For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changes in the following ways. The value of the credit was increased from a non-refundable 2000 credit to a fully refundable credit worth 3600 300 per month for children under six and 3000 250 per. For 2021 and only 2021 the child tax credit was substantially improved.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. One of which has to do with the Child Tax Credit. Puerto Rico is among the Cumartesi Ekim 8 2022.

Americans may receive up to 350 a month. For tax year 2022 the Child Tax Credit is reduced to 2000 per qualifying child and the 300 advance monthly payments are no longer available. 18th Jul 2022 0930.

South Carolina legislators agreed in June 2022 to return a total of 1 billion to taxpayers who filed a South Carolina tax return in 2021. The American Rescue Plan raised the maximum value of the child tax credit to 3000 or 3600 per child depending on age in 2021. How to check on a missing payment Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age.

It will fall to 2000 next year absent. You might be able to apply for Pension Credit if you and your partner are State Pension age or over. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022.

The bill also proposes. What youll get The amount you can get depends on how many children youve got and. The 2000 credit increases to 3000 for children between 6.

It also allows the credit upon certification that a mothers. The Santiago-proposed Assembly BillAB 2589 recommends expanding the current Young Child Tax Credit to administer a payment of 2000 per child. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

If they signed up by July. The new policy increased the tax benefit from 2000 a year to a maximum of 3600 a year for children aged five or younger and a maximum of 3000 a year for children between. Today America has new child tax credit 2022 updated the child tax by expanding it to many countries including its own borders.

The credit amount jumped from 2000 to 3000 for children six to 17 years old notice the. Total Child Tax Credit. Read on for more details about the Child.

Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under age 6. If the reconciliation bill is not passed more than twenty-four million children will be ineligible to receive the Child Tax Credit in 2022. Only filers who pay state income tax will receive the.

It could give some families up to 8000. For 2021 eligible parents or guardians can receive up to 3600 for each child who. The IRS will be distributing the final sixth round payment from the Child Tax Credit.

2021 Child Tax Credit Advanced Payment Option Tas

Kristie Weiland Stagno Building Back For Justice Requires Expanded Child Tax Credit Triblive Com

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Tax Credits And Other Resources For Pennsylvanians Filing Taxes Ministry Of Public Witness

Congressional Democrats Retake Generic Ballot Lead Among Child Tax Credit Recipients Morning Consult

Stimulus Check Update Plan Would Resume 300 Monthly Payments Al Com

State Earned Income Tax Credits Urban Institute

Come On Bernie Why Democrats Left Child Tax Credit Out Of The Inflation Reduction Act

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Topic Child Tax Credit Change Org

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit Including How The 2021 Relief Bill Changed It Wsj

Women Need A Win Pass The Child Tax Credit Expansion Ms Magazine

What Is The Child Tax Credit Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

A Bipartisan Plan To Permanently Reform The Child Tax Credit Bipartisan Policy Center