haven t filed taxes in 15 years

Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

5 Reminders If You Haven T Filed Taxes Ahead Of Monday S Deadline

The IRS doesnt pay old refunds.

. Filing six years 2014 to 2019 to get into. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. But I havent filed taxes in over 15 years.

If the IRS filed for you youll want to. Failure to file penalty 5 of unpaid tax per month. Next you and your tax pro should open and maintain the lines of communication with the IRS.

I received a letter stating that the state of Virginia is putting a lien on my wages for a fail tax year which is 1994 that they say I didnt file. I have a new client who has not filed a. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

If youre missing forms you can call them and have them send you their copies of all forms relating to you that theyve received pay stubs T2202As etc. In the US about 75 of people get a refund because they have overpaid their taxes through withholding during the year. Do teenagers have to file taxes.

Underpayment penalty 05. Galstyan a certified public accountant at. But the first year that I had to document my own expenses handle my own deductions.

If youre late on filing youll almost always have to contend with these two penalties. After that the IRS will assess the FTF penalty on your tax debt if you still havent filed. 15 2023 for the victims of Hurricane Ian in Florida says Levon L.

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the. For example the IRS has extended the deadline for filing taxes to Feb. This is because the CRA charges penalties for filing and paying taxes late.

Earn less than that. What happens if you dont file taxes for one year. The extension will give you until around October 15th to file your return.

The IRS doesnt pay old refunds. Then you just file and. Americans are legally required to file federal tax returns when they make at least 12550 the standard deduction for the 2021 tax year.

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. The deadline for claiming refunds on 2016 tax returns is April 15 2020. In almost every case we see no you do not need to file every year.

Filing taxes was no big deal when I was getting a W-2 form. Confirm that the IRS is looking for only six years of returns. Even if you request an.

Your tax pro can file your returns and act as your intermediary between you and the IRS. The IRS generally wants to see the last seven years of returns on file. But I havent filed taxes in.

The Secret Irs Files Trove Of Never Before Seen Records Reveal How The Wealthiest Avoid Income Tax Propublica

Trying To Reach The Irs Very Few Callers Getting Through

July 15 2020 Is Tax Day What To Do If You Haven T Filed Yet

What Happens If I Haven T Filed Taxes In Over Ten Years

Never Filed Taxes Ever 18 Years Old Didn T Check Any Boxes Non Filer 5 2 Got Psna Until 5 15 Checked Gmp And Have A Dd For 20th R Stimuluscheck

Claim A Missing Previous Tax Refund Or Check From The Irs

Get Back On Track With The Irs When You Haven T Filed H R Block

Dena Bonnier Siepert Co Llp Certified Public Accountants

What Happens If You Don T File Taxes Is Not Filing Taxes A Crime Legalmatch

Have You Filed Your Taxes Yet If Not Here Are Tips For Procrastinators Orange County Register

How To File Taxes Cashnetusa Blog Filing Taxes Tax Help Tax Day

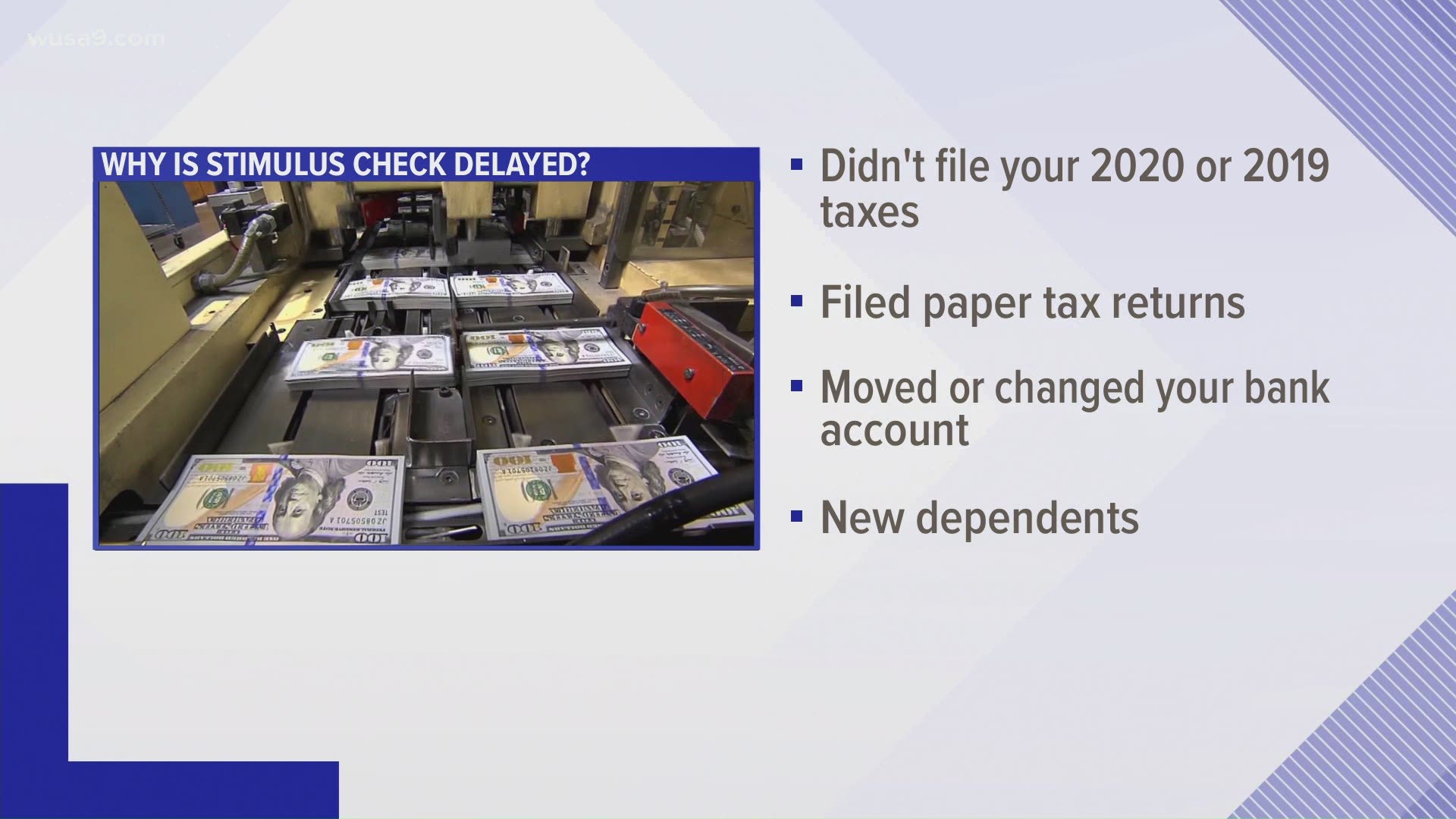

When Are 2020 Taxes Due Claiming Stimulus Checks May 15 Irs Wusa9 Com

Monday Is Tax Day Here S What Happens If You File Late Oregonlive Com

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Taxes Are Due Next Week Here S What You Need To Know In Wisconsin

5 Reminders If You Haven T Filed Taxes Ahead Of Monday S Deadline

Irs Publishes Q As On Filing Deadline Extension Alloy Silverstein

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)